Curb The Menace Of Unsolicited Commercial Communications

A solution for enhancing the consistency, correctness, and dependability of data by changing or removing repetitious, erroneous, incomplete, or improperly structured entries from a database

Trivia

Need For DLT Solution

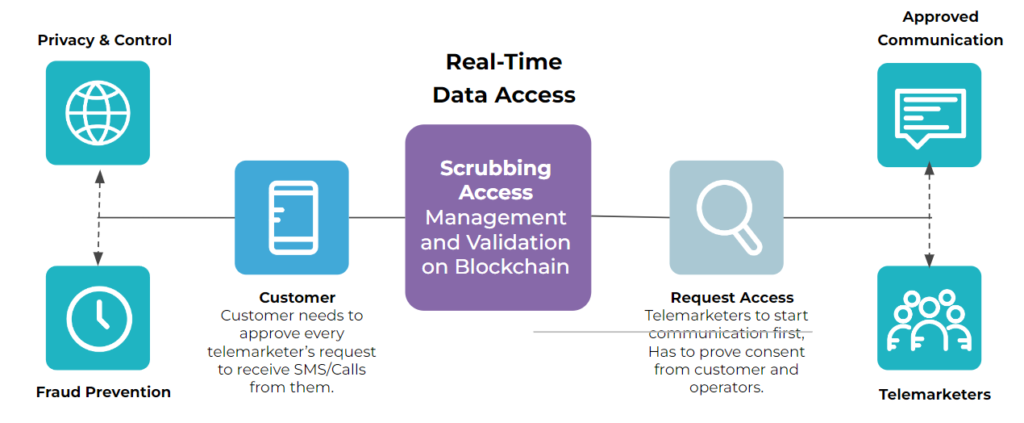

The DLT-enabled data scrubbing solution authenticates the sender-id and checks the header and content of every commercial SMS generated from a registered source to throttle spam and fraudulent messages.

How it works?

Features

Use Cases

Online ticket Booking

Using DLT-based data scrubbing, customers’ names, addresses, and payment details can be securely stored, encrypted, and distributed across multiple nodes. This will also help to protect customers from fraud, as the data involved in ticket booking transactions cannot tamper with, and customers can enjoy a secure and efficient online ticket booking experience.

eCommerce Sales

A DLT-based data scrubbing technology could be used in eCommerce sales to ensure the accuracy and integrity of customer data. By utilizing a distributed ledger, customer data could be securely stored and updated in real time. This would enable customers to quickly and easily update their personal information while allowing businesses to ensure that all customer data is accurate and up-to-date.

Banking

Banks can use DLT-based data scrubbing to quickly and accurately verify customer information before entering it into their system. Banks can also use DLT-based data scrubbing to detect and prevent fraud by quickly validating customer data in real time.